March 29, 2023

7 Ways Credit Union Members Can Raise Their Credit Scores

One of your credit union’s goals is to help improve your members’ lives – and helping them improve their financial life can boost the rest of their life. One way to do so is by assisting members in bumping up their credit scores. An increase in credit score can give your members access to better deals on loans, mortgages, insurance options, and more.

Credit union members often turn to their credit union for support and assistance when it comes to bettering their financial situation, so here are some helpful tips you can provide when a member asks you how they can strengthen their credit score:

Pay Current Bills (Don’t Miss Payments!)

One of the easiest ways your members can improve their credit scores is by paying bills on time. If your members aren’t taking advantage of autopay, they should use a tried-and-true calendar to mark down due dates – or utilize different smartphone scheduling apps that will remind them a payment is coming up. Your members should ensure they’re not missing a loan or credit card payment by more than 29 days. If a payment is at least 30 days late, it can be reported to a credit bureau – and that’s when credit scores will begin to drop.

Pay Past-Due Accounts

In addition to paying their current balance, members should pay down their past-due accounts. Doing this will also help prevent more late payments from being added to their credit history. Another plus? Members will pay fewer late fees, and a lower credit balance means paying less of that costly interest.

Limit New Account Applications

Submitting a credit application can lead to a hard hit on your credit score – which can bring it down a bit. These inquiries can quickly add up and have a compounding effect.

Also, whenever a member adds new credit to their account, they decrease their credit history length. A FICO study found that people with an 800+ credit score had an average credit account age of ten and a half years. While your members do not necessarily need this credit age to have a good score, they should be aware that adding new credit cards can impact the age of their credit history and their score.

Double-Check Your Credit Report for Inaccurate Information

Occasionally, credit reporting agencies will need to correct their facts. Your members should scan their credit reports to ensure that the information on there is accurate. If there is inaccurate information, there are ways to dispute this via phone, mail, and online.

One thing to check is timeframe: there are different timeframes for how long negative information will stay on your credit report, and if it’s on there past these limits, it’s time for your member to report it for removal:

• Late or missed payments can stay on a credit report for up to seven years.

• Chapter 7 bankruptcy can stay on for up to 10 years, while Chapter 13 bankruptcy will appear for up to seven.

• Charge-offs, repossessions, foreclosures, and other indications of defaulting on an account cannot be reported longer than seven years after the original delinquency date.

Do Not Close Old Accounts

It might be tempting to wipe off any trace of an old student loan from a credit report once it’s paid off (and congratulations would be for that feat!). But keeping those debt records on their credit report might benefit your members. If their payments were timely and completed, they would show a strong credit track record.

If old credit cards are on an account, those should not be closed either. Closing credit cards can lower a member’s credit score (because they’ll be reducing their maximum credit limit, and their utilization ratio will increase). So, it’s best to leave those old accounts on there and let them fall off naturally over time.

Develop and Maintain Better Credit Habits

One of the quickest ways to see a decline in credit scores is by falling back into old ways. Once your members have hit a good score, which is typically a 690 or higher, some other ways they keep it there by:

• Putting their credit card payments on autopay. Even if you miss one payment, your credit can begin to plummet, and autopay helps ensure that doesn’t happen. Make sure your members know all the cards they have open, too. Sneaky store credit cards may have a balance that can easily be forgotten because they might not reach for their Lowe’s or American Eagle credit card daily. These should be turned to autopay, too.

• Keeping an eye out for bills that come in. For example, it might be easy to forget that medical bill that was delivered via snail mail. But those can quickly be sent to collections, and a collections account will impact a credit score, causing it to drop.

• Monitoring their credit report to ensure that nothing suspicious is happening. Credit reports will watch for identity theft – and many different free and paid credit reporting services can help alert your members if that occurs.

• Using their credit cards moderately. It has been advised that credit card utilization should be less than 30% of the credit card’s limit. So, if your member has a $10,000 credit card limit, they should not be using more than $3,000 of that limit.

Offer Your Members a Credit Score Solution

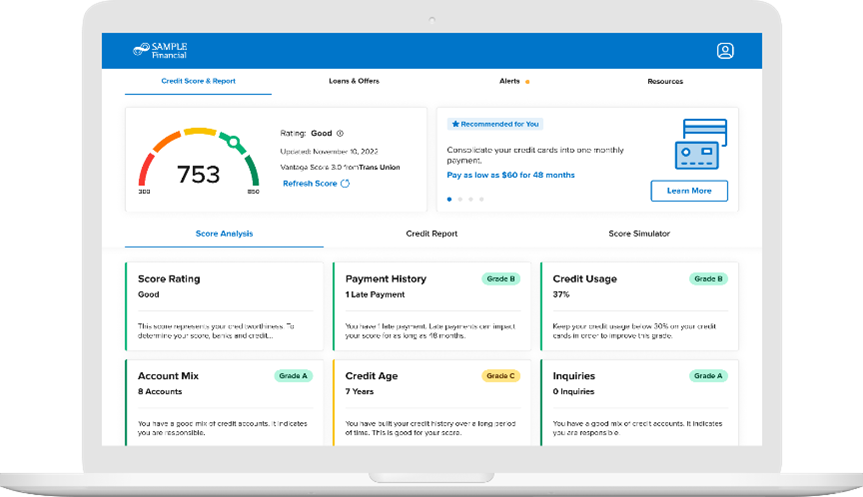

Another way to lend a hand to your members regarding credit scoring is by offering them an innovative solution that provides real-time credit scores. When your credit union leverages Sharetec’s core processing solution, you can add on SavvyMoney’s robust credit score solution. SavvyMoney provides:

• Real-time credit scores, right in the Sharetec mobile & desktop member platform

• Details on member credit score and history, so they can further understand what makes up their credit score, including payment history, credit usage, and credit age

• Access to financial education tools so that members can make better informed financial decisions

With the economic turbulence in a post-pandemic world, there’s no better time to provide credit scoring assistance to your members. And with Sharetec and SavvyMoney, you can help them navigate these choppy financial waters and make better decisions together for a brighter financial future tomorrow. If you’re ready to learn more about Sharetec’s core processing software for credit unions and SavvyMoney, contact us today!