September 26, 2024

Push Notifications: Why Your Credit Union Should be Using Them

There’s no denying it. Everyone is on their phone all day, every day. Okay, that may be an exaggeration, but Americans rely heavily on their mobile devices today, with almost 100% saying they have their phone within reach 24/7. It’s a preferred form of communication, entertainment, streaming, and, yes, even banking. As of 2022, 78% of U.S. adults preferred to bank on their mobile app or online, opting out of driving to their branch to bank in person.

With the heavy reliance on smartphones, it’s more than advantageous for credit unions and other financial institutions to embrace mobile banking. But, with mobile banking, how do you ensure you interact with your members proactively and timely? With push notifications. ICYMI, push notifications are brief messages that pop up as alerts on a user’s device. The information is automatically pushed to the member without them having to log into your mobile banking app to find that update.

Push notifications serve various purposes and typically fall under one of three categories: transactional, promotional, or engagement. Transactional will be directly related to a specific action, such as a payment coming due. A promotional push notification is exactly what it sounds like: it notifies the user of a promotion, such as a new interest rate or loan offering. And lastly, engagement. These push notifications encourage a user to interact with the app. While not listed as one of the three primary purposes of push notifications, you can also use them to “notify.” Is your branch going to be closed for a holiday? Are your hours changing? Is there bad weather and you’ll have to close early? These are all instances when an informational push notification can help you communicate with your members.

The “Why” of Push Notifications: Why Should I Use Them?

We are bombarded with different marketing and communication strategies that we can execute, but sometimes, time and resources are limited, so we must pick and choose. Push notifications are a quick and easy way to ramp up your omnichannel communication strategy.

Push notifications can be a powerful tool for your credit union because they:

- Allow for Immediate Engagement: Your push notifications will be delivered directly to your members’ devices when you want them to be. Schedule your push notifications or push them out immediately. Your notification will almost instantly appear on your members’ device screens. This is especially useful for informational updates, such as closures.

- Provide Personalized Service: As fewer members decide to come into the branch, your credit union may worry about a lack of personalization. Credit unions stand out amongst other FIs because of their focus on relationships, but this can be a more difficult differentiator to uphold if members are at home. With push notifications, you can tailor them based on your member’s financial data and behavior patterns. Do they qualify for an auto loan, and have they recently been around car dealerships? Send them a personalized, geotargeted push notification to inform them of this relevant promotion.

- Increase Your Visibility: Don’t get lost in the noise of emails. The average open rate for emails is less than 2%, while push notifications have an average open rate of 20%. Push notifications also have a substantially higher delivery rate of 90%, which is 50% higher than email. By using a push notification, you’re helping to ensure your message doesn’t get lost in a crowded inbox. It will appear prominently on your app user’s home screen.

- Improve Member Retention: Push notifications will keep your credit union at the top of your members’ minds. There are a variety of ways you can improve member retention with push notifications:

- Giving your new app users or members a warm welcome

- Providing members a reason to come back to your app, such as new features and relevant promotions

- Retargeting members who are applicable for specific promotions and products

- Sending out a member satisfaction survey to get their feedback on your credit union

- Encourage Immediate Action: Push notifications can help to drive immediate action: finishing a loan application, checking an account balance, or taking advantage of a limited-time offer before it’s

- Elevate Cross-Promotion: Use push notifications to cross-promote your financial products and services! In what ways are you using Sharetec cross-selling now? Adding push notifications to that mix may help elevate the results you’re already experiencing from cross-selling.

Push Notifications & Sharetec On-the-Go Mobile

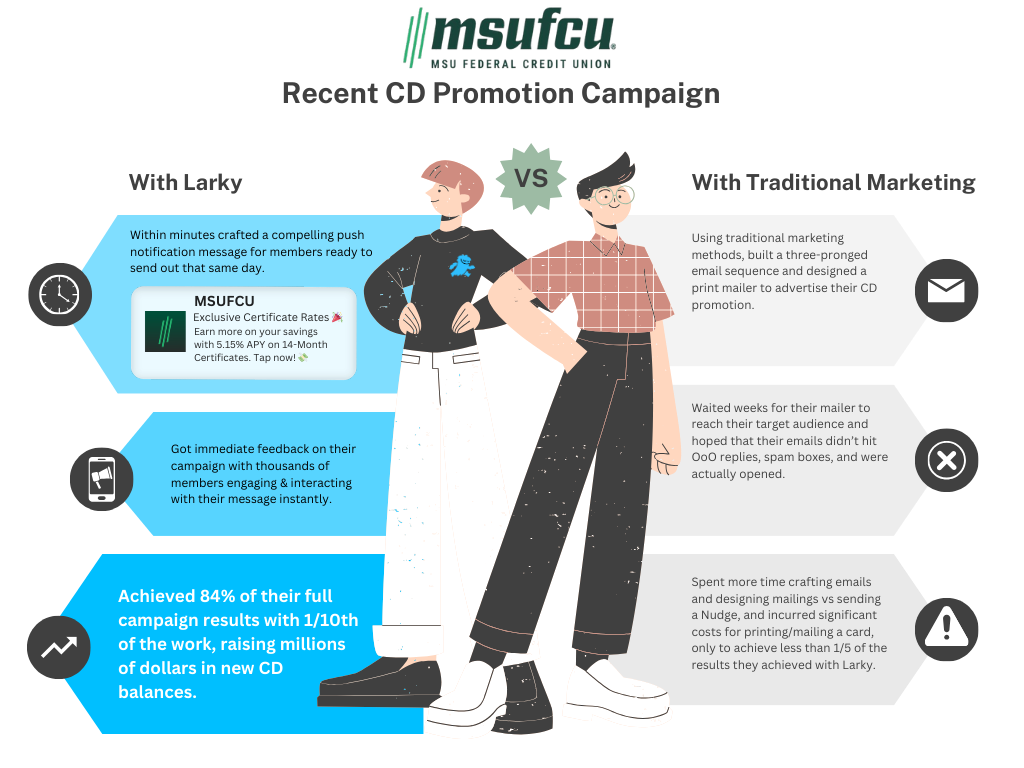

Without push notification capabilities, a mobile banking platform wouldn’t be complete in 2024 (and beyond). Sharetec On-the-Go Mobile includes Larky nudge® Basic for all Sharetec digital banking customers. With Larky, it’s easy to spin up a push notification to: increase deposits, stop fraud events, boost card usage, promote new financial products and services, and drive loan volume. It only takes a few minutes to craft a compelling push notification message within Larky and send it out that same day. Larky’s push notifications can lead to a 7x increase in engagement when compared to traditional marketing methods.

But, don’t just take our word for it. Larky has been delighting Sharetec credit union customers, so hear what they have to say.

Want to learn more about Sharetec On-the-Go Mobile and the Larky integration? Whether you’re looking to send a basic push notification here and there or want to discover Larky nudge Advanced and dive into the work of geotargeted messaging, contact a Sharetec representative today. If we’re like almost 100% of Americans, we have our phone within reach and will get back to you shortly!