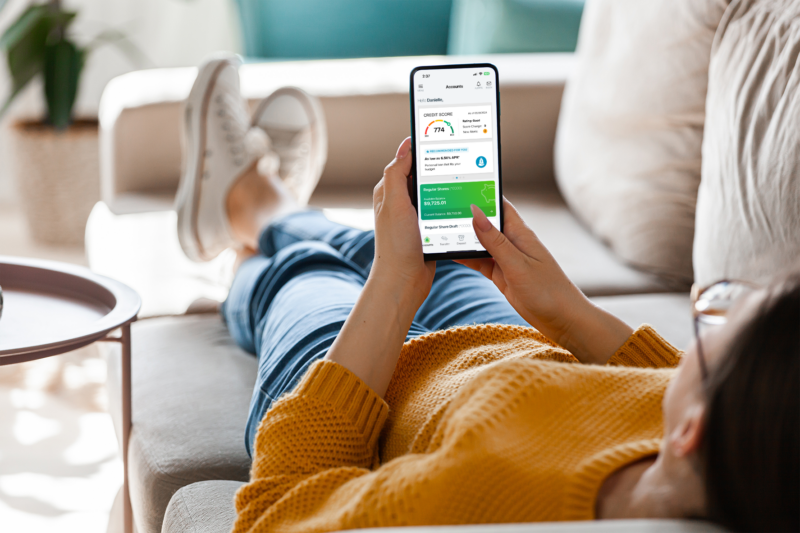

Credit scoring and financial literacy. Right at members’ fingertips.

Sharetec’s partnership and integration with SavvyMoney, a fin-tech industry innovator and provider of credit score and other related financial solutions for every online and mobile banking platform, provides comprehensive credit score analysis, full credit reporting, monitoring, and personalized offers -accessible in one dashboard, with no extra fees.

SAVVYMONEYWhy offer SavvyMoney?

Your credit union and members will thrive.

SavvyMoney’s robust credit score solutions and digital personalization build customer loyalty and strengthen your bottom line. Analytics give you actionable insights into score improvement, loan engagement, and competitor analysis. Automatically deliver right to the customer – saving them money and helping you drive profitable loan growth.

With Sharetec On-the-Go Digital Banking, you can offer SavvyMoney to all of your members. Sharetec On-the-Go mobile now features the SavvyMoney mobile widget, which gets SavvyMoney front and center on your mobile app when members log in.

Book more loans.

It's possible with SavvyMoney.

With SavvyMoney, it’s possible to book more loans, and the proof is in the pudding. SWECU, a Sharetec client, was able to book 393 loans in just 18 months, totaling over $9.3 million.

How? With SavvyMoney’s online banking widget and a full SavvyMoney landing page. That, tied with targeted drip campaigns, Sharetec Cross Sell Metrics, and Savvy “Wallet Share” led to a spike in loan revenue.

How will your members benefit from Savvy?

With SavvyMoney, your members can take control of their credit and will have instant access to their credit score, credit report, personalized money-saving offers, and financial education tips on how to improve their score. Help them understand their credit score, factors that impact it, and what they can do to strengthen it.

Credit Score

Members today demand instant access to their credit score. Empower them with Savvy's innovative credit score solutions that integrate with Sharetec On-the-Go.

Robust Analytics

Savvy's analytics give you actionable insights into score improvement, loan engagement, and competitor analysis. The result? You can automatically deliver the right offer to the right member — saving them money and helping you drive profitable loan growth.

Loan Offers & Promotions

With Savvy's advanced marketing tools, you’ll be able to optimize multiple creative ads to effectively reach and influence your members. Additionally, you can increase conversion rates through Savvy's seamless pre-screened experiences.

Financial Education

Members are looking to you for help managing their credit and finances. Savvy's financial personalization and customized content help them navigate financial decisions — and make you look good.

SavvyMoney Instant Access

Auto enroll your members into Savvy

SavvyMoney Instant Access allows you to maximize digital engagement while driving loan conversion. Instead of waiting for your members to discover SavvyMoney on their own inside Sharetec On-the-Go Digital Banking, they will automatically be enrolled. Right away, you’ll see an increase in users from about 40% to nearly 100%.

Within 30 days, credit unions typically see a whopping 96% of their members enrolled, which means you’ll get more loan promotions in front of them. Plus, members are more likely to increase their credit score when it’s in front of them. Win-win.

Ready to schedule a demo?

We want to show you all that Sharetec and SavvyMoney have to offer!

"*" indicates required fields