Data-Driven Lending Decisions

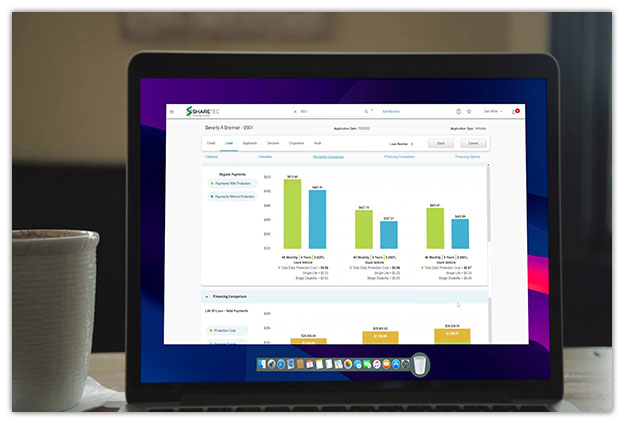

Sharetec Lending Workspace

Your lenders require accurate data, clear standards, and an efficient application process. Enter the Sharetec Lending Workspace, our online solution to manage and monitor your lending process. Sharetec’s data tracking tools and decision screens are a main strength of the core, putting all the correct information in the right place at the right time to simplify decisions and track changes. It’s the logical choice for anybody seeking to make complicated things more manageable.

Lending Features

Sharetec Lending Workspace offers a range of features to streamline your workflow, including:

Online Member Services 2.0

OMS 2.0 enables members and non-members to apply for loans through their credit union's website. Plus, our Plaid integration connects applicant's funding FI to their application in seconds.

Automated Lending

Speed up the loan decision-making process by automating tasks such as credit checks and income verification.

Collections

The Sharetec Collections System streamlines processes to manage member-level delinquencies. All relevant information about a member is displayed in one queue, including delinquent loans, credit cards, and negative share accounts.

Escrow Analysis

Escrow Analysis generates member statements for all future transactions, including all deposits to escrow for loan payments and disbursements from escrow for taxes and insurance payments, during the analysis period.

Home Equity Processing

Automatically calculate the new payment amount and the effective date for each loan, providing your credit union staff with a chronological online history of every payment and rate change.

Indirect Lending

Sharetec tracks disbursed and denied loans for each dealer, updating loan counts and amounts. Sharetec automatically produces a statement for the lender if a previously denied loan is approved.

Ready to schedule a demo?

Please contact us if you're not entirely satisfied with your current system provider or if you are interested in moving to a fully web app system. At Sharetec, we focus on improving customer-facing experiences. We hope to hear from you soon!

"*" indicates required fields